A research team from Michigan State University has won recognition in an international competition focused on privacy-enhancing technologies (PET) that bolster democracy. The groundbreaking results of their research were showcased at the second White House Summit for Democracy, convened by President Joe Biden from March 28-30, 2023.

Led by Jiayu Zhou, associate professor of computer science and engineering at MSU, the team collaborated with researchers from the University of Calgary to secure third place in the Financial Crime Prevention Track. Zhou, who heads MSU's ILLIDAN Lab, guided his doctoral students Haobo Zhang and Junyuan Hong, alongside Professor Steve Drew, head of the DENOS Lab at the University of Calgary, and his graduate student, Fan Dong.

World-leading experts from academic institutions, global technology companies, and privacy start-ups competed for cash prizes from a combined United States-United Kingdom prize pool of $1.6 million. The winning solutions addressed practical data privacy concerns in real world scenarios related to financial crime and pandemic responses. Read more on the U.S. PETs Prize Challenge.

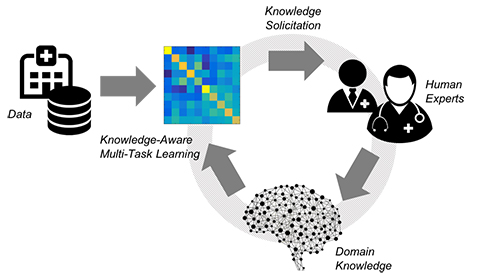

Zhou explained that the ILLIDAN Lab specializes in developing novel machine learning solutions, focusing on transfer learning, robust learning, and federated learning methodologies and theories. Meanwhile, the DENOS Lab leads groundbreaking research in distributed learning systems, federated learning, AIOps, edge computing, and cloud-native initiatives for blockchain services.

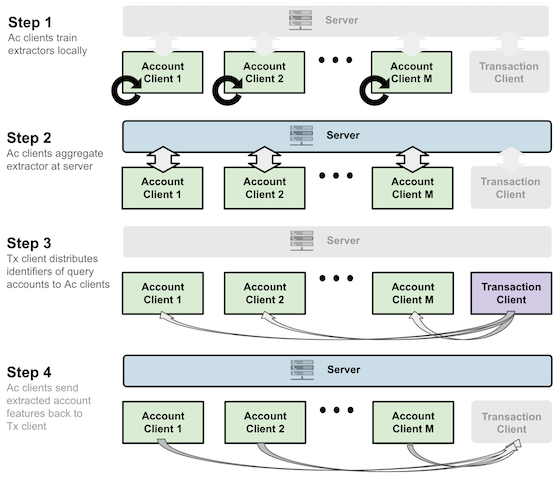

He said the team developed a novel trustworthy machine-learning approach that enables the collaborative detection of financial crime across multiple financial institutions while offering enhanced privacy protections. This technology can also be applied to analyze distributed and sensitive data while providing privacy protections.

“Modeling financial crime for battling financial crimes is an urgent task that requires in-depth collaboration from multiple financial institutions, and yet such collaboration imposed significant technical challenges due to the privacy and security requirements of distributed financial data,” Zhou explained. “Training a detection model of fraudulent transactions requires not only secured SWIFT transactions but also the private account activities of those involved in each transaction from corresponding bank systems.

“The distributed nature of both samples and features prevents most existing learning systems from being directly adopted to handle the detection task. We developed a hybrid federated learning system that offers secure and privacy-aware learning and inference for financial crime detection,” he added.